NJ FA-0520 2018-2026 free printable template

Show details

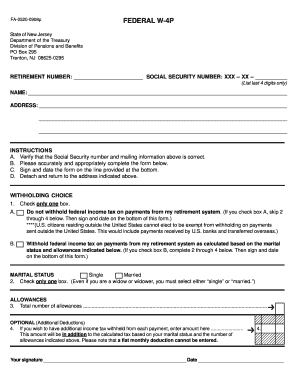

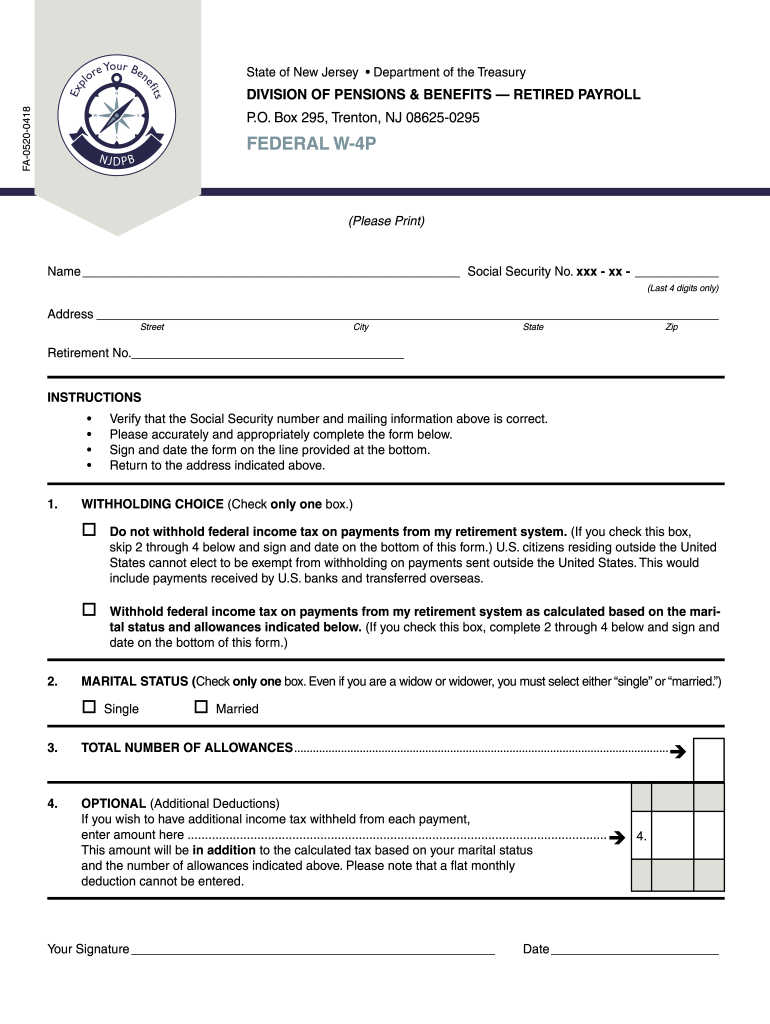

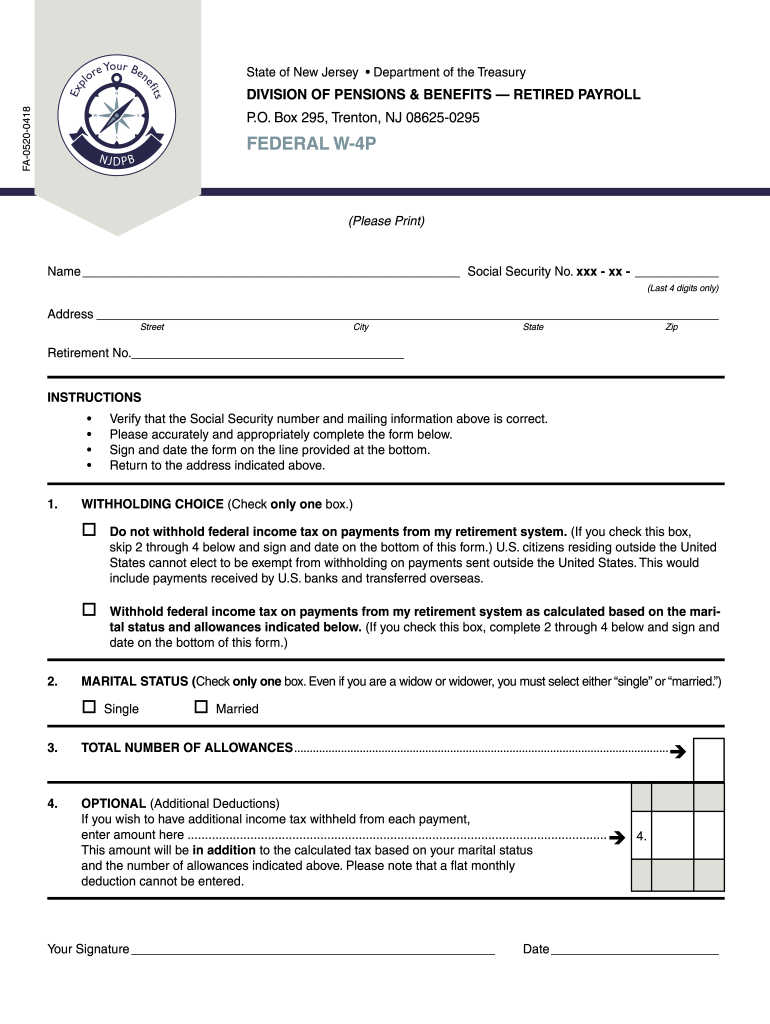

State of New Jersey Department of the Treasury FA-0520-0418 DIVISION OF PENSIONS BENEFITS retired payroll P. O. Box 295 Trenton NJ 08625-0295 FEDERAL W-4P Please Print Name Social Security No. xxx - xx - Last 4 digits only Address Street City State Zip Retirement No. INSTRUCTIONS Verify that the Social Security number and mailing information above is correct. State of New Jersey Department of the Treasury FA-0520-0418 DIVISION OF PENSIONS BENEFITS retired payroll P. O. Box 295 Trenton NJ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ FA-0520

Edit your NJ FA-0520 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ FA-0520 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NJ FA-0520 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NJ FA-0520. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ FA-0520 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ FA-0520

How to fill out NJ FA-0520

01

Begin by finding the NJ FA-0520 form online or at your local government office.

02

Fill in your personal information at the top of the form, including your name, address, and contact information.

03

Provide information regarding your financial situation, including income sources and amounts.

04

Detail your expenses by listing all monthly bills and other financial obligations.

05

Include documentation that supports your financial statements, such as pay stubs or bank statements.

06

Review the completed form for accuracy and completeness.

07

Submit the form by the due date indicated on the instructions, ensuring you keep a copy for your records.

Who needs NJ FA-0520?

01

Individuals or families seeking financial assistance in New Jersey may need to fill out NJ FA-0520.

02

Anyone applying for specific state or local benefits related to financial aid might also require this form.

Fill

form

: Try Risk Free

People Also Ask about

What is a 1040?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

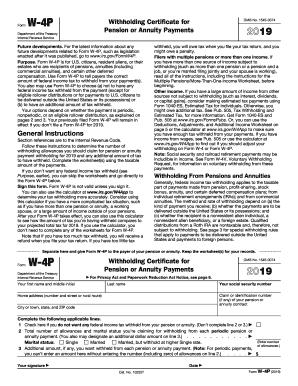

What is form 4P?

Purpose of form. Complete Form W-4P to have payers withhold the correct amount of federal income tax from your periodic pension, annuity (including commercial annuities), profit-sharing and stock bonus plan, or IRA payments. Federal income tax withholding applies to the taxable part of these payments.

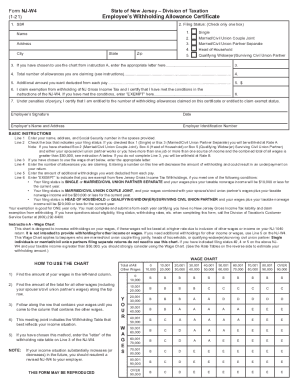

How many allowances should I claim on NC-4?

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

What is form W-4P used for?

Purpose of form. Complete Form W-4P to have payers withhold the correct amount of federal income tax from your periodic pension, annuity (including commercial annuities), profit-sharing and stock bonus plan, or IRA payments. Federal income tax withholding applies to the taxable part of these payments.

What is an NC 4P form?

Form NC-4P is for North Carolina residents who are recipients of income from pensions, annuities, and certain other deferred compensation plans. Use the form to tell payers whether you want any State income tax withheld and on what basis. You can also use the form to choose not to have State income tax withheld.

Is form W-4P mandatory?

The use of the revised forms was optional for the 2022 tax year, but will become mandatory for the 2023 tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NJ FA-0520 online?

Completing and signing NJ FA-0520 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit NJ FA-0520 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share NJ FA-0520 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I complete NJ FA-0520 on an Android device?

Use the pdfFiller app for Android to finish your NJ FA-0520. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is NJ FA-0520?

NJ FA-0520 is a form used by businesses in New Jersey to report their estimated business income and assess tax liabilities.

Who is required to file NJ FA-0520?

Any business entity that anticipates owing New Jersey Corporation Business Tax must file the NJ FA-0520.

How to fill out NJ FA-0520?

To fill out NJ FA-0520, businesses must provide their estimated gross income, deductions, and calculate the estimated tax due based on their projected income.

What is the purpose of NJ FA-0520?

The purpose of NJ FA-0520 is to enable New Jersey businesses to report estimated tax payments and ensure compliance with state tax requirements.

What information must be reported on NJ FA-0520?

NJ FA-0520 requires reporting information such as the business's name, address, federal tax identification number, estimated gross income, deductions, and estimated tax due.

Fill out your NJ FA-0520 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ FA-0520 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.